According to a CBC report the average price of a Canadian

home was $401,585 in July, a five per cent rise compared to last year.

The Canadian Real Estate Association repeated its claim that

booming sales in the large, pricey markets of Vancouver and Toronto are skewing

the national average higher.

If those two cities are stripped out of the equation, the

average Canadian home is worth $327,988 and the year-over-year increase shrinks

to four per cent.

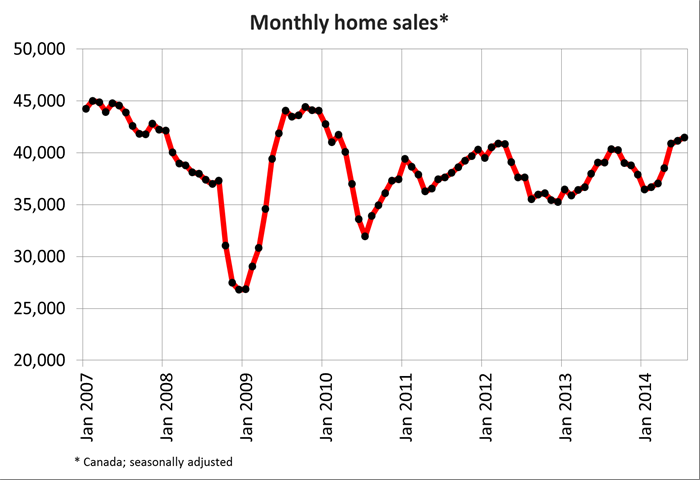

Sales hit a high

The real estate market is going strong, based on the number

of houses being sold.

Sales have been climbing steadily — rising slightly for the

sixth consecutive month.

July marks the highest level of home sales since March 2010,

the agency said. Sales activity was 7.2 per cent higher than the same month a

year ago.

Increases in sales activity for July also grew in markets

such as Victoria and Winnipeg, and the Ontario markets of Ottawa, London and

St. Thomas.

“On the surface, national sales activity in July was similar

to what we saw in May and June,” said CREA president Beth Crosbie. “That said,

July sales picked up in markets that struggled to gain traction in the spring,

while activity eased slightly in some of Canada’s largest urban markets."

This growth shift from Calgary, Toronto and Vancouver to

other regions of Canada could indicate a future trend.

"This could mark the start of less regional diversity

in housing markets, which saw strength generally in the Western provinces and

weakness in Central and Atlantic Canada (except Toronto)," Sal Guatieri,

senior economist at BMO Capital Markets.

"The renewed momentum in Canada's housing market in

recent months represents both a bounce back from weather-related weakness over

the winter months and a response to lower mortgage rates," said Leslie

Preston of TD Economics.

"Potential buyers who may have sat on the sidelines

last year as interest rates rose, are being enticed back to the market by lower

interest rates. Meanwhile, a strengthening in economic growth continues to

support the fundamental demand in the housing market."

Market may cool off

This growth spurt may not last much longer.

TD Economics believes that the Canadian housing market will

cool later this year and into the next.

Preston says existing home prices "…are on track to

outstrip income growth for a second straight year in 2014, which adds to

concerns about an already-overpriced market."

She adds that a likely increase in interest rates and the

added supply of new homes currently under construction are expected to weigh on

prices as well.

Until this happens however, Guatieri remains concerned with

THE upward climb of prices in Calgary, Toronto and Vancouver.

"While there will always be condos to satisfy the

demand for reasonably affordable housing in these cities, the widening gap in

prices versus detached homes means that a lot of young, growing families will

be forced to live the condo lifestyle for much longer than they intend."

CREA Statistics Highlights:

- National home sales rose 0.8% from June to July.

- Actual (not seasonally adjusted) activity was 7.2% higher than July 2013 levels.

- The number of newly listed homes edged up 0.4% from June to July.

- The Canadian housing market remains in balanced territory.

- The MLS® Home Price Index (HPI) rose 5.3% year-over-year in July.

- The national average sale price rose 5.0% on a year-over-year basis in July.

For more insight into the housing market of Whitby, Brooklin and other areas of Durham region, please contact me or visit my website.

Randy Miller

Broker

Re/Max Rouge River Realty Ltd., Brokerage

905-668-1800 or 905-427-1400

randy@randymiller.ca

Broker

Re/Max Rouge River Realty Ltd., Brokerage

905-668-1800 or 905-427-1400

randy@randymiller.ca

No comments:

Post a Comment